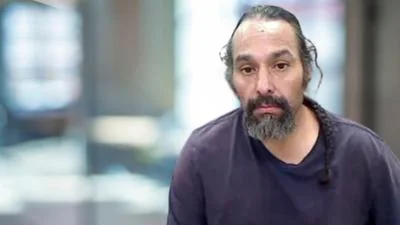

River Forest's Ralph Martire, the state's leading advocate of tax increases, is about to get his wish. | Youtube

River Forest's Ralph Martire, the state's leading advocate of tax increases, is about to get his wish. | Youtube

When state legislators and their aides analyzing a 500-page public education bill have had questions — about what its language intended, or what its complex mathematical formulas meant — they've heard a common response.

"You'll have to ask Ralph."

They mean River Forest’s Ralph Martire, the veteran lobbyist for Illinois teacher's unions and the man behind Senate Bill 1, a wholesale revamp of how the state distributes tax dollars across its K-12 school system.

If the bill becomes law, state tax money will no longer be allocated by Springfield to school districts “per student,” but instead to meet hiring and spending criteria required by the state.

That is, spending criteria authored by Martire — a man whose public advocacy is underwritten by the very public employees school districts would now be required to hire.

Martire runs the Center for Tax and Budget Accountability (CTBA), a left-wing advocacy group founded by the state’s largest public employee unions two decades ago to argue for higher property, income and sales tax increases, all to fund higher salaries and bigger pensions for their members.

Martire’s longtime financial backers see SB1 as a political masterstroke.

In arguing for tax increases, now Martire and his supporters will hold a trump card: state law.

Communities that won’t raise taxes to spend what the state deems an “adequate” amount of money on their public schools could be denied their share of complementary state school funds.

They could also be taken to court, charged with violating the statutory dictates of Martire’s Senate Bill 1, which will establish spending minimums for everything from school staffing levels to hiring of extracurricular instructors and athletic coaches, and purchases of student computers.

SB1 makes K-12 education akin to an entitlement like Medicaid, with guaranteed automatic funding increases, its effectiveness measured not by results but, rather, tax dollars spent.

Martire believes that in the future, legislators should be actually prohibited from cutting spending on public education.

He says his plan will take the “political calculation” out of funding schools, in which K-12 schools compete with other state priorities for limited tax dollars.

“By completely divorcing education funding from the actual cost of educating children, Illinois has effectively implemented a school funding regime designed to frustrate the state’s admirable constitutional goals for public education,” Martire writes.

“Focusing on inputs”

State public school spending minimums are the work product of Martire, who argues more spending on teacher salaries and benefits will lead to improved education for Illinois schoolchildren.

Martire believes schools trying to improve student performance should focus less on classroom changes, like vetting curriculum or firing ineffective teachers, and more on how much money they are spending.

“By focusing on school ‘inputs,’ (my funding model) facilitates investment in those best practices that have a statistically meaningful correlation to enhancing student achievement over time,” Martire writes.

Martire’s “best practices” don’t address actual teaching methodologies but, rather, how many employees a school should hire and how much to pay them.

And they aren’t vague, setting precise student-to-public employee ratios for teachers, administrators, coaches, janitors and other school support staff. “Best practices” include how much to spend on iPads for students ($285.50) and mandated spending on teacher “professional development” activities.

The Illinois State Board of Education (ISBE) will now require school boards and principals to follow Martire’s spending roadmap, inspired by state teacher’s unions who have financed his advocacy work.

Public K-12 schools, sparing no expense

The advocacy of Martire and teacher’s unions has already proven successful, even before SB1’s emergence.

Martire has led teacher union opposition to structural reforms to education — like allowing parental choice of their children’s school and ending teacher tenure.

He argues that while these ideas might improve education for students, they would also result in fewer taxpayer-funded jobs for his backers as bad teachers lose their jobs or parents opt to send their children to higher-performing schools.

Illinois taxpayers already spend more on public schools each year than all other state government functions combined. And that total continues to grow.

An LGIS analysis found that over the past two decades, K-12 public school enrollment has risen six percent. But taxpayer spending on K-12 schools has grown more than 12 times faster — 73 percent, to $37 billion per year, up from $21 billion in 1997, adjusted for inflation.

Much of this spending has been borrowed, as school district administrators have been allowed to deficit-spend.

Illinois school districts — backed by property taxpayers — owe more than $102 billion, according to data compiled by LGIS from the Illinois State Board of Education and Illinois Department of Insurance (DOI). This debt is weighing on local school budgets and property values.

Most of the money has been spent on increased teacher salaries and pension benefits.

According to their DOI filings, the average Chicago Public Schools (CPS) teacher earned $93,796 in 2016, up 40 percent from $66,898 in 2005, adjusted for inflation.

The average downstate and suburban teacher earned $83,451, up 27 percent from 2005, according to state filings.

Normalized for a full year of work — teachers work nine months each year — Chicago teachers earn an average of $125,061 per year and downstate and suburban ones $111,268.

The median household income in Illinois is $59,588, according to the latest numbers from the U.S. Census.

Double your income tax. Or more.

The passage of SB1 represents a milestone Martire has been pursuing for nearly 20 years.

Following its spending requirements to the letter of the new law will force an increase in school district hiring that can only be funded with massive tax increases, Martire hopes.

Martire’s CTBA is backed by the state’s most vociferous advocates of a large tax increases-- including a state sales tax of 12.5 percent on all services, like haircuts or lawn mowing, and a progressive income tax with a top rate for higher earners of 11 or 12 percent.

CTBA Board members include Dan Montgomery, President of the Illinois Federation for Teachers (IFT), Illinois AFL-CIO President Michael Carrigan, AFSCME Council 31 executive John Cameron and William McNary, director of the openly socialist Illinois Citizen Action.

It also includes Riverside Village Board Member Jean Sussman and former downstate school superintendent Marleis Trover, mother of Lance Trover, formerly a communications manager for Gov. Bruce Rauner.

Alerts Sign-up

Alerts Sign-up