Camille Y Lilly, State Representative for 78th District | Official Website

Camille Y Lilly, State Representative for 78th District | Official Website

According to the Illinois General Assembly site, the legislature summarized the bill's official text as follows: "Amends the Department of Commerce and Economic Opportunity Law of the Civil Administrative Code of Illinois. Provides that the Department shall establish and implement a Veterans' Economic Center pilot program for the purposes of assisting veterans in finding employment and addressing the problem of veteran homelessness. Amends the Illinois Income Tax Act and the Economic Development for a Growing Economy Tax Credit Act. Provides that a taxpayer who receives a credit under the Act for a taxable year ending on or before December 31, 2027 pursuant an Agreement entered into on or after the effective date of the amendatory Act may apply only 98% of that credit amount against his or her State income tax liability in any taxable year. Provides that the remaining 2% of the total credit amount awarded shall be transferred from the General Revenue Fund into the Veterans' Economic Center Fund. Provides that moneys in the Veterans' Economic Center Fund shall be used by the Department of Commerce and Economic Opportunity to administer the Veterans' Economic Center pilot program. Amends the State Finance Act to create the Veterans' Economic Center Fund. Effective immediately."

The following is our breakdown, based on the actual bill text, and may include interpretation to clarify its provisions.

In essence, this bill establishes a Veterans' Economic Center pilot program, running from Jan. 1, 2026, to Dec. 31, 2029, to aid veterans in finding employment and tackling homelessness. The Department of Commerce and Economic Opportunity will partner with local employers and report the program's effectiveness by Dec. 31, 2029. The bill amends tax legislation, allowing only 98% of certain tax credits to be applied against state income tax, with the remaining 2% transferred to the Veterans' Economic Center Fund. This fund will finance the pilot program. The bill is effective immediately upon becoming law, and the program section will be repealed on Jan. 1, 2031.

Lilly graduated from Drake University in Des Moines in 1983 with a BS.

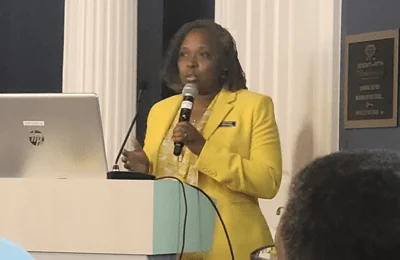

Camille Y. Lilly is currently serving in the Illinois State House, representing the state's 78th House District. She replaced previous state representative Deborah L. Graham in 2010.

Bills in Illinois follow a multi-step legislative process, beginning with introduction in either the House or Senate, followed by committee review, floor debates, and votes in both chambers before reaching the governor for approval or veto. The General Assembly operates on a biennial schedule, and while typically thousands of bills are introduced each session, only a fraction successfully pass through the process to become law.

You can read more about bills and other measures here.

| Bill Number | Date Introduced | Short Description |

|---|---|---|

| HB1503 | 01/21/2025 | Amends the Department of Commerce and Economic Opportunity Law of the Civil Administrative Code of Illinois. Provides that the Department shall establish and implement a Veterans' Economic Center pilot program for the purposes of assisting veterans in finding employment and addressing the problem of veteran homelessness. Amends the Illinois Income Tax Act and the Economic Development for a Growing Economy Tax Credit Act. Provides that a taxpayer who receives a credit under the Act for a taxable year ending on or before December 31, 2027 pursuant an Agreement entered into on or after the effective date of the amendatory Act may apply only 98% of that credit amount against his or her State income tax liability in any taxable year. Provides that the remaining 2% of the total credit amount awarded shall be transferred from the General Revenue Fund into the Veterans' Economic Center Fund. Provides that moneys in the Veterans' Economic Center Fund shall be used by the Department of Commerce and Economic Opportunity to administer the Veterans' Economic Center pilot program. Amends the State Finance Act to create the Veterans' Economic Center Fund. Effective immediately. |

Alerts Sign-up

Alerts Sign-up